by admin | Dec 18, 2025 | Wills, Inheritance Laws, Estate Planning

If Santa Made a Will, Who’s Getting the Sleigh? Santa delivers presents to the entire planet once a year, so it’s only fair to ask the big question — if Santa popped his clogs, who’s inheriting the North Pole empire? With a workshop full of valuable toys, a global...

by admin | Oct 17, 2025 | Wills, Estate Planning

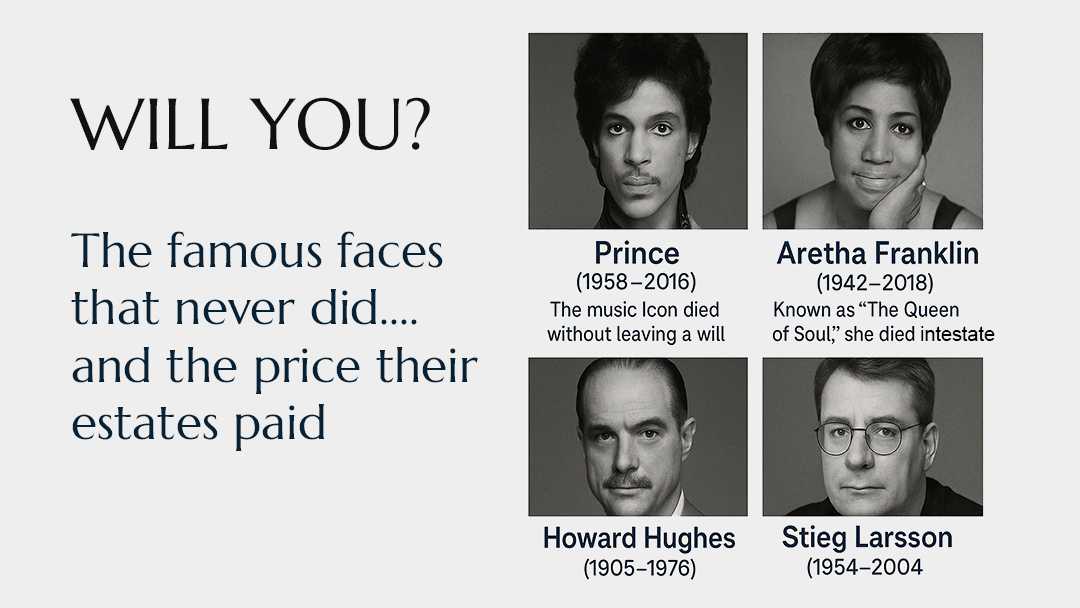

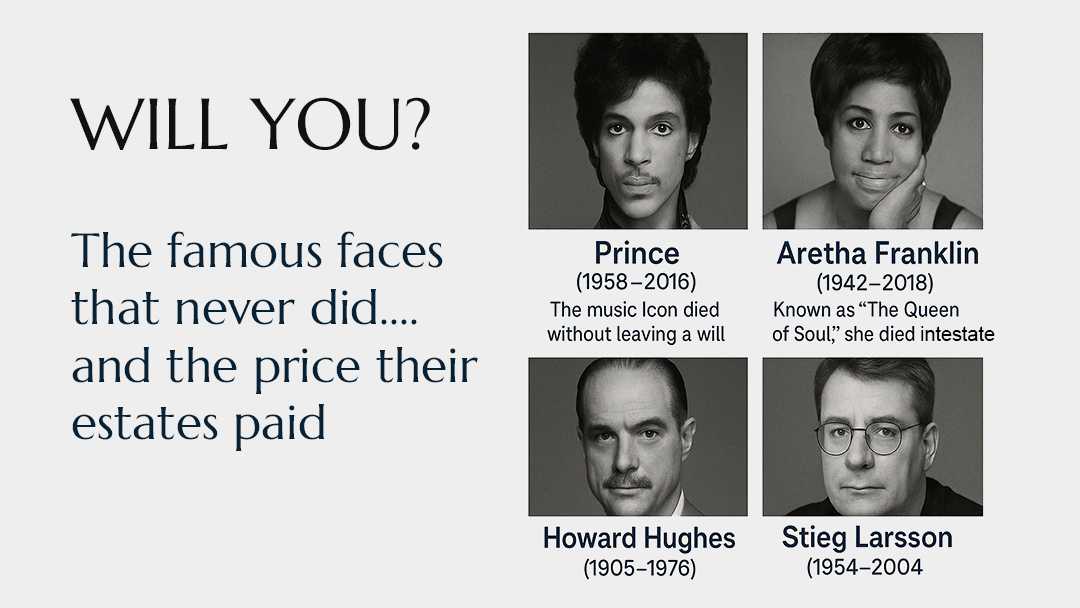

Estate planning might not feel glamorous, but when the spotlight’s on a loved one’s passing, the absence of a will can become painfully visible. Dying without a will — known in legal terms as intestacy — can turn what would have been a private family matter into a...

by admin | Aug 8, 2025 | Inheritance Laws, Estate Planning

Why Your Estate Might Get Taxed More—And What You Can Do About It Inheritance tax (IHT) has long been one of the most controversial levies in the UK. Once seen as something only the very wealthy would encounter, it’s increasingly catching out ordinary families—thanks...

by admin | Dec 11, 2024 | Inheritance Laws, Estate Planning

In today’s digital age, wealth extends far beyond physical property or traditional bank accounts. Digital assets like cryptocurrencies, NFTs, and online investments have become valuable parts of many individuals’ portfolios. However, these assets are...

by admin | Sep 30, 2024 | Inheritance Laws, Estate Planning

Inheritance tax (IHT) can significantly reduce the value of what you leave behind for your loved ones. In the UK, estates valued above £325,000 are subject to a 40% tax on the amount exceeding that threshold. However, with smart estate planning, there are legal and...

by admin | Aug 7, 2024 | Estate Planning

Planning your estate is about more than just distributing your assets after you’re gone. It’s equally important to consider how to manage any debts and liabilities. Failing to account for these financial obligations can lead to complications for your heirs and...